by Altimese Nichole | Feb 16, 2016 | Learn + Grow

An unfortunate reality centers around the need for higher education in America and the lack of resources and support around educating students (and alumni) about student loan debt. it is the responsibility for the borrower of the student loans to learn the various outlets, payment plans, and resources available to them.

For people like me, I have both private and federally funded student loans. Federal loans are regulated by the government and often have lower rates and loan forgiveness plans for respective fields. Private loans are at the discretion of the lender and often vary through the terms and conditions within the loans.

Some people accept that student loans are a part of life and plan to pay them for the rest of their lives; I refuse to be one of them. As crazy as it sounds, I’ve always declared that I will be free from student loan debt– or all debt for that matter. As I began my journey last year, I found out some things that are truly eye-opening, and worth sharing with you.

Student loans can never be included in a bankruptcy.

Contrary to all other forms of debt, by law student loans can never be forgiven into any form of bankruptcy. They are also transferrable after death (which will be noted within the terms and conditions). This means that for some, family members and loved ones will be responsible for your debt after you die.

Private Loan interests can roll into the principal amount, and it’s legal.

When I originally signed for my loans– my collective amount for undergrad was approximately 35K. during my forbearance period after graduation, the principal grew from 35K to 55K. How in the world did that happen?! Well, during forbearance periods after graduation, the maximum amount of interest accrues on the loans. Once your forbearance period is over, the lender can transfer your interest amount to the principal, essentially securing the payment of that interest for that time given. The worst thing anyone can do is continue to place student loans in forbearance when they have the funds to pay them. It will only hurt you in the long run.

Co-signers can be released.

After you have paid your loans for some time and have made on-time payments, borrowers can request the lender to release the co-signer from the responsibility of the loan. There are quite a few required steps to make this happen (like an age requirement, credit check, proof of income, etc.) but it’s worth investigating. Im sure the co-signer will be grateful.

Loan consolidation is not always best

With student loans, borrowers can consolidate (also called refinance) student loans ONE time during the lifetime of the loan. Most decide to do that to minimize the multiple interest rates, which can ultimately lower the monthly payment. For those who want to pay the loans off before the expected term end date, loan consolidation may not be best. Why? With a large loan amount, it’s much harder to pay that off vs. multiple small loans. It’s easier to see a “light” at the end of the tunnel if you’re focusing on paying off a student loan of 10K instead of a large loan of 80K. If you go this route, always tackle your lowest loan first and use the Dave Ramsey Domino effect and move to your next loan to pay off.

Student loan debt doesn’t have to be a part of our lives for the rest of our lives (and potentially the remaining lives of your loved ones). Be proactive and get educated on the options that are available to you!

Do you have any additional tips to share?

XOXO

by Altimese Nichole | Oct 20, 2015 | Lifestyle+Culture

Growing up in a single family home was tough at times. All financial responsibility for the home fell on my mother – and she worked two jobs the majority of my childhood to make ends meet. In the midst of the difficult journey, my mother took the time to pour invaluable wisdom in my life— after all, we were all we had.

One of the many things she taught me while growing up was centered around finances. Having a financial background and career, she made it a point to teach me core financial nuggets of wisdom. If your heart is open to receive, I would like to share a few with you:

- Credit is EVER-REY-THANG!

So is credit really everything? YES. Credit is EVERYTHANG!!!

“If you have a bill due and no grocery in your house and your contemplating on which one to pay—pay that bill first. Because of your decision to pay that bill, you can easily go to the bank to request a 0% APR loan, which will help you to pay for those grocery for your home. But never, ever neglect your bills unless unforeseen circumstances force you into that position. If that’s the case, communicate with your collectors. If you tell them upfront, they’re more willing to help you through it vs. a lack of communication and an abundance of unpaid bills.” ~ My mom

It sounds crazy but America’s score of your responsibility matters. They don’t see you struggling to pay your bills but that score will follow you wherever you are in life, for the rest of your life. I am a personal testimony of this. While in college, I followed my mom’s advice and used ONE credit card to build my credit (which is still the same company for the one credit card I have now as an adult). Within one year, my score doubled. I needed a car but had no down payment since I was still in school. I went to a dealership and within a few hours I drove off the lot with a brand new car, a 4% interest rate, and no down payment needed. Don’t be fooled; protect that credit score the way you would protect your most valuable possessions.

- Make Credit Cards Work for YOU

“To build credit, get ONE credit card (all you need is one) and put $100 or $200 dollars on it each, and PAY IT OFF. Continue to do that each month and it will trigger your score in a positive way.”~Mom

Never have an on-going balance on your card. By doing so, your become obligated to pay interest. Additionally, get a card that has a great rewards system. This will help you earn points toward free gift cards, flights, hotels, and more. I personally know quite a few people who pay their bills through their cards to maximize their points. Let me explain… Instead of using the money that they ALREADY HAVE in their bank account to pay their bills directly, they go through a process: they pay their bill with their rewards card first, wait for the points to accumulated, and then pay off the credit card in total. IF (and only if) you’re highly engaged with monitoring your card and you’re self-disciplined to do this would it be recommended. However, this method uses the credit card to the advantage of the consumer.

- Use the Cash-and-Carry Method

“Every now and then, assess your spending habits and do a financial clease through the cash-and-carry method. Carry just cash and keep your receipts. At the end of the month, see what you’re really investing your money in.” ~My mom

Have you ever noticed that if you take out money from the bank, you tend to hold onto it much longer than you would the money on your debit card? When we physically see the money transaction, we tend to think twice about our purchases. If you’re trying to get a handle on your finances, I highly encourage the cash-and- carry method, leavening your cards at home. For emergencies, dust that check book off, and carry it with your cash! Why the checkbook? Checks are so archaic yet so very intentional. To write a check, you’re deliberately thinking about the money you’re spending—and you will have access to your account, should life throw you a curveball.

- The Co-signing Trap

“Never co-sign unless you’re married to the person you’re co-signing for. Even in that case, be careful. The co-signer holds the primary responsibility for the loan. So, should the initial borrower fail to make payments, the collector has the right to immediately go after the co-signer. Just don’t do it. Not for friends and definitely not for family.” ~My mom

Her words said it all. No explanation is needed.

- Ignorance Isn’t Bliss

“Just because you don’t know about financial responsibility it doesn’t give you a pass to do immature things when it comes to money. Financial matters involve numbers. Numbers don’t lie and care nothing about concept, ideas, hopes and dreams.” ~My Mom

Make financial education a personal goal in your life. Read books, research the companies your working with, and learn about 401k’s and investment opportunities. Financial matters are personal yet brutally public if not handled properly. Educate yourself. In a world with all information at our fingertips, we truly have no excuse anymore.

Have you ever received great financial advice? Please share with the STRONG community!

by Torrie Oglesby | Aug 27, 2015 | Lifestyle+Culture

Back in 1913, when President Woodrow Wilson signed the Federal Reserve Act something monumental changed in the way America decided to handle our money. He decided, on executive order, to have our money controlled by a private banking agency, which is The Federal Reserve. Congress didn’t know about this and the public didn’t know about this either. Only a selective handful of people were aware of what was happening.

Fast forward to 2015 and what cost you $1.00 now only cost .04 cents in 1913. That’s a 96% devaluation of the dollar since this act came in to existence. With the system that is in place right now, the dollar is only going to continue to decrease. How does this affect you and what can you do to prepare for what lies ahead?

The first thing you need to know is that it most certainly affects you which is why it’s important to educate yourself on it and why I felt called to write this article. You and I need to be mindful of what is happening with the economy. I suggest to be weary of false news and to only listen to the few voices out there that are being honest with what is happening. Two that I want to suggest are Alex Jones and Ron Paul. Alex can be found at www.infowars.com and Ron Paul can be found on www.ronpaul.com

Secondly, you need to know what inflation truly is. Inflation is NOT just the price of everything going up, but also the value of the dollar going down. If our dollar is decreasing this means we need to be preparing for when/if it collapse completely. We need to be investing our money into necessary commodities, the necessities of life. For example, long storage food, gasoline, and your basic survival tools. The last thing you want, is for the economy to crash and you and your family not be prepared.

I’m not saying to stop enjoying life and doing fun things with your money, but perhaps budget a certain amount of money each paycheck to go towards an emergency kit that will be able to help you and your loved ones survive. My husband and I have adopted this habit and it’s very reassuring. I’m not writing this article to scare you but to educate you and fill you with hope. If an economic crash ever happened I want us all to be prepared and ready because when you’re prepared fear has no hold.

With love and big smiles,

torrie

by Nadya Logan | Aug 18, 2015 | Lifestyle+Culture

The holidays are nearing soon, and if you have a big family like mine, then you probably started saving for gifts in January. For those of you have not, and are interested in doing so, here’s a way to begin budgeting your funds.

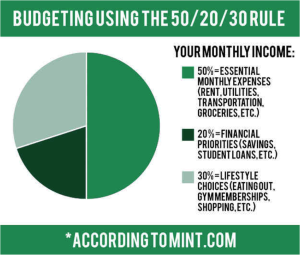

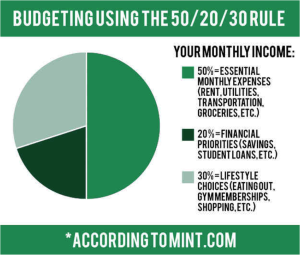

According to Mint, a financial management company powered by Intuit, the 50/20/30 rule “can help twenty-somethings sort out the complicated world of personal financeâ€. Meaning that not only can this budgeting guideline be useful during the time leading up to the holidays, but it can be used during all times of the year.

As reported by the chart, 50% of your income should go to anything you’d classify as an “absolute necessity of lifeâ€. This can include, but is not limited to: Rent, Transportation, Groceries, and Utilities. If you would be homeless if you didn’t pay for it, then more than likely, you should be investing 50% or less of your income on it.

The company also advises that you put 20% of your income into your financial priorities. For instance, if you’re 24-years old, you understand that retirement is something that you will need in about 30-40 years from today and you may have student loans to pay back—which is why putting 20% (or more) of your money into any financial obligations that you are taking care of now (and possibly in the future) would be the responsible thing to do. This way, if our economy tanks, and the government runs out of money to fund social security, you will be able to take care of yourself.

As stated on the website, 30% of your income should go to “voluntary obligations that enhance your lifestyleâ€. Things that can be considered a voluntary obligation could be eating out, a gym membership, shopping, or your cell phone/internet/cable plan. But although all of these things are considered a luxury, most people cannot function successfully in our society without having a good cell phone plan or eating out every once in a while, whether for business purposes or personal pleasure.

And as I stated in the beginning of this article, the holidays are coming up soon. So you can mark your mother’s STRONG Box yearlong subscription into your voluntary-obligation category.

If you want more information on the 50/20/30 rule, you find it at https://www.mint.com/budgeting-3/the-minimalist-guide-to-budgeting-in-your-20s

by Jasmine Shirley | Jul 18, 2015 | Learn + Grow

I was a young mother and although I was blessed to keep my life at home I needed to provide for my little one. I had heard all of the “horror” stories about parenthood, so to be sure that I was able to provide financially I started saving. Saving early has put me in the position to shop, travel and live comfortably at the age of 24. Here are 5 ways I was able to get here:

- Take advantage of gift cards

- When the holidays rolled around and those relatives that didn’t know what to get me gave me gift cards your girl saved them like my life depended on them. Gas cards, movie cards, restaurant cards, save them and use them whenever you are able to

- The envelope method

- The envelope method is used typically when budgeting and to save you will need a budget honey. Once my money was deposited into my bank account I would leave the amount needed for any automatic transactions such as phone bill, rent, etc.

- Then I would take envelopes and label them according to my expenses: gas, food, shopping, etc.

- The money, if any, that was left over and not needed for my automatic expenses is the money that I would take out and distribute into the envelopes.

- Buy a Safe

- Target has a few safe options you can purchase. I purchased a safe that I kept in my room. The money that I was not using for going out, shopping or eating out I would put away in this safe and pretend to forget about it

- Over time I would continue to add to the safe instead of making envelopes for leisure activities and soon I needed a bigger safe.

- Get a savings account

- I got a savings account once I got the hang of budgeting my own money. One I opened a savings account I had a certain amount of money deposited into my savings account each paycheck.

- I started off with just $5 and began to add more when I got multiple jobs or more income

- More Income

- When school was out or I had extra help with my child I was able to work multiple jobs at a time. With more income there is more money that can be saved.

- Consigning clothes was something I really got into. As the trends changed or the need for more money came I would go to consignment shops, Plato’s Closet, and sell any and everything they would take.

- Saving my change really made a difference in my income. I would throw my change in a water jug or my old save and every 6months to a year I would go to CoinStar and cash it in. You will be surprised what your change can add up to.

Spread Love and Happy Saving!

Jasmine Shirley

![STRONG, Inc. [Simple Transitions Render Opportunity Necessary For Growth]](https://www.knowyourstrong.org/wp-content/uploads/2023/04/NewLogo.png)

Recent Comments