The holidays are nearing soon, and if you have a big family like mine, then you probably started saving for gifts in January. For those of you have not, and are interested in doing so, here’s a way to begin budgeting your funds.

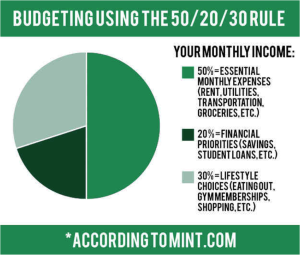

According to Mint, a financial management company powered by Intuit, the 50/20/30 rule “can help twenty-somethings sort out the complicated world of personal financeâ€. Meaning that not only can this budgeting guideline be useful during the time leading up to the holidays, but it can be used during all times of the year.

As reported by the chart, 50% of your income should go to anything you’d classify as an “absolute necessity of lifeâ€. This can include, but is not limited to: Rent, Transportation, Groceries, and Utilities. If you would be homeless if you didn’t pay for it, then more than likely, you should be investing 50% or less of your income on it.

The company also advises that you put 20% of your income into your financial priorities. For instance, if you’re 24-years old, you understand that retirement is something that you will need in about 30-40 years from today and you may have student loans to pay back—which is why putting 20% (or more) of your money into any financial obligations that you are taking care of now (and possibly in the future) would be the responsible thing to do. This way, if our economy tanks, and the government runs out of money to fund social security, you will be able to take care of yourself.

As stated on the website, 30% of your income should go to “voluntary obligations that enhance your lifestyleâ€. Things that can be considered a voluntary obligation could be eating out, a gym membership, shopping, or your cell phone/internet/cable plan. But although all of these things are considered a luxury, most people cannot function successfully in our society without having a good cell phone plan or eating out every once in a while, whether for business purposes or personal pleasure.

And as I stated in the beginning of this article, the holidays are coming up soon. So you can mark your mother’s STRONG Box yearlong subscription into your voluntary-obligation category.

If you want more information on the 50/20/30 rule, you find it at https://www.mint.com/budgeting-3/the-minimalist-guide-to-budgeting-in-your-20s

![STRONG, Inc. [Simple Transitions Render Opportunity Necessary For Growth]](https://www.knowyourstrong.org/wp-content/uploads/2023/04/NewLogo.png)

Recent Comments